The average number of days needed to sell a used car shrank across many European markets last month, bucking a recent trend. Compared with May’s figures, Austria, Germany, Italy, Spain and the UK all saw speedier transactions take place for 36-month-old vehicles at 60,000km.

The UK witnessed the fastest turnaround at 38.5 days, falling by 0.1 days month on month. Austria recorded one of the longer periods at 74.1 days, although this was still a drop of 2.4 days on average compared with May. The exceptions were Switzerland and France, with used cars waiting for an additional 3.7 and 3.4 days on average to find a new owner.

Absolute residual values were stable across Europe in June, with the majority of markets enjoying positive momentum. Italy saw the strongest rate of month-on-month RV growth at 3.9%, meaning 36-month-old cars traded for an average of €20,815. At the other end of the spectrum, the UK saw absolute trade RVs dip by 3.3% to £17,792 (€20,775).

Most of the markets under review saw %RVs decline month on month, if only by a marginal amount. The UK took the largest drop at 3%, down to 64%, while France and Italy saw %RV increases. Recording month-on-month growth of 0.5% and 0.3% respectively, both markets hit a %RV of 55.9%.

Comparing the sales-volume and active-market volume indices reveals that used-vehicle supply is still overshadowed by demand. However, this trend was far less pronounced than in May, with only four of the seven markets under review affected.

For example, while France’s active-market volume index saw one of the greatest month-on-month drops at 4.7%, this was still outweighed by its 12.6% fall in demand. But demand did outstrip supply in Italy, Spain and Austria, where the sales-volume index saw respective inclines of 23%, 18% and 6.9%.

Click here to open the interactive dashboard

Click here to open the interactive dashboardThe interactive monthly market dashboard examines Austria, France, Germany, Italy, Spain, Switzerland, and the UK. It includes a breakdown of key performance indicators by fuel type, including RVs, new-car list prices, selling days, sales volume and active-market volume indices.

Scenario analysis

The current base-case scenario of low supply and falling demand has both positive and negative ramifications. Used-car prices and demand would come under pressure should Europe’s economic situation deteriorate.

If new-car supply suddenly improved as supply-chain issues ease, this outcome would worsen. While the semiconductor shortage appears to have improved, McKinsey analysis points towards a shortage of specific chips persisting until at least the summer of 2025, if not longer.

On the other hand, if new-car supply was disrupted again, the used-car market would likely benefit in the short term as consumers explored alternatives to factory-fresh models. This could occur if supply chains took a hit due to economic turbulence or exceptional energy prices. Conflict would have the same impact, as has been seen with the war in Ukraine.

However, in the longer term, a lack of new car supply would result in a shrivelled supply of young used cars, pushing consumers towards older models. This would create an issue, as environmental regulations look to discourage the uptake of more polluting models.

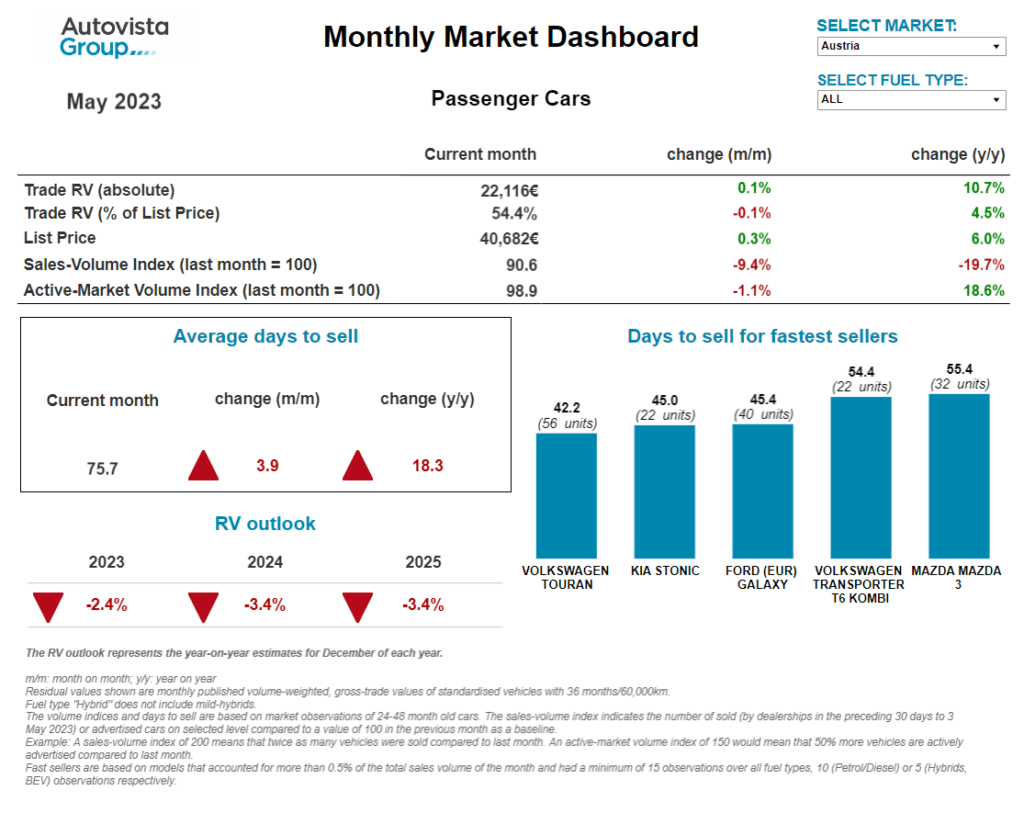

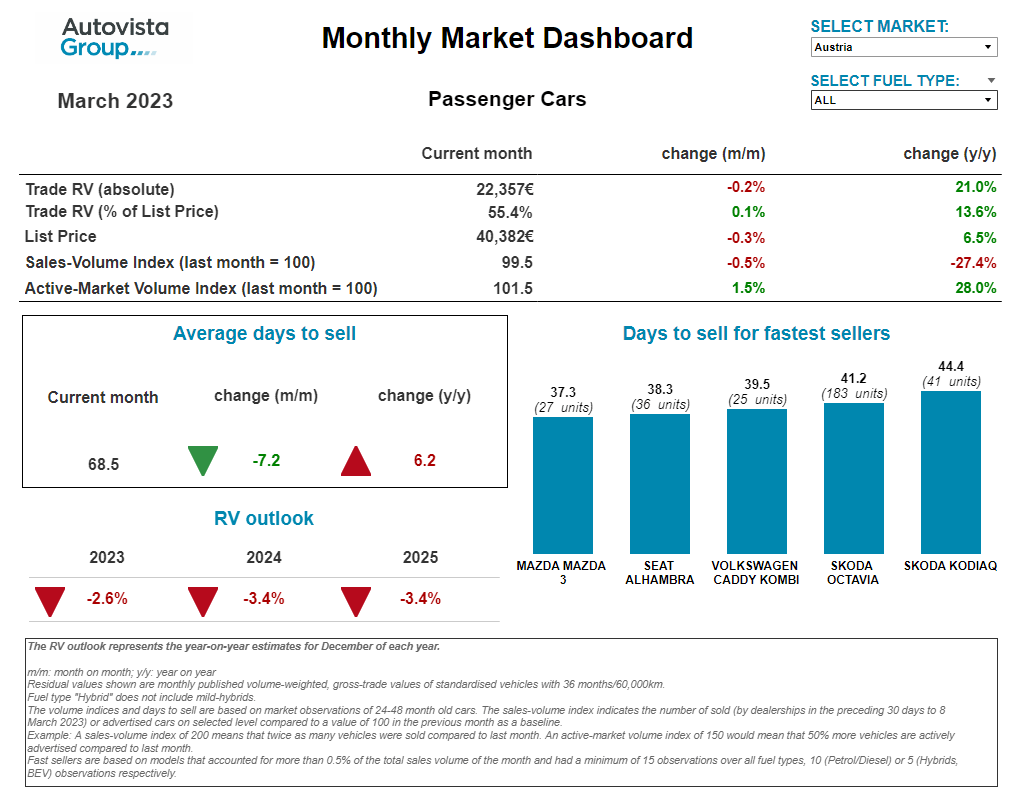

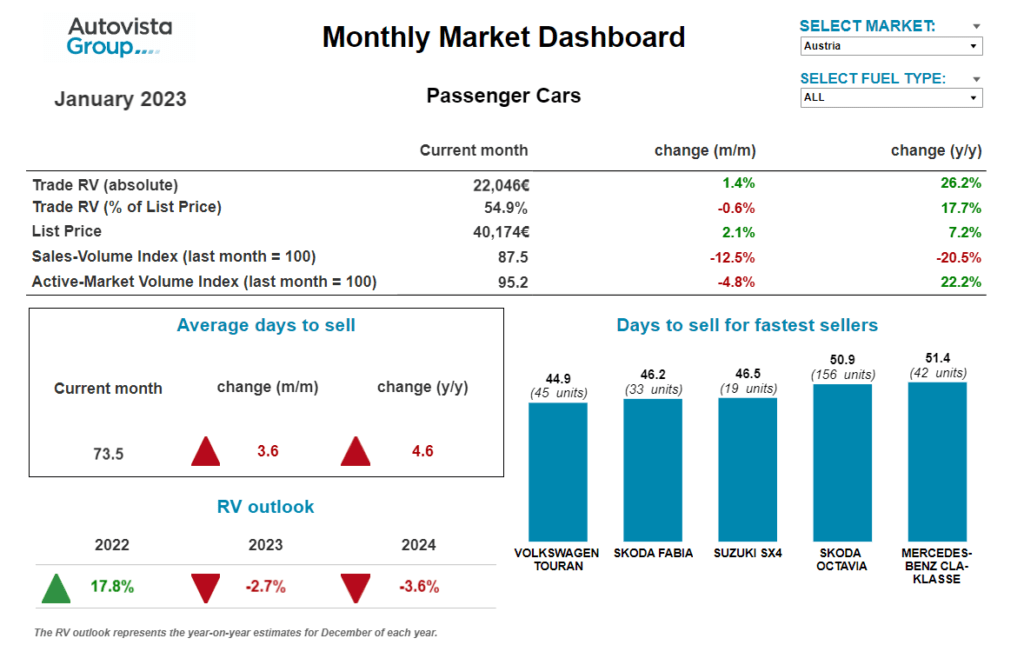

Austria’s mounting RV pressure

Compared with 2022, living costs continued to climb in Austria as used-car transactions sank. The sales volume index did reveal stronger demand in June compared with May, increasing 6.9% month on month. However, the sales volume index was down 1.9% year on year.

Meanwhile, the supply volume of passenger cars aged two-to-four years was around 11% higher in June than a year earlier. But in 2022, supply was significantly lower than before the COVID-19 pandemic at the beginning of 2020.

Following a steady increase earlier in the year, the average number of days it took to sell a used car decreased to 74.1 days in June, confirming a slowdown in demand. Petrol cars sold the fastest, averaging around 72 days, followed by hybrid-electric vehicles (HEVs), diesel cars and plug-in hybrids (PHEVs) with around 74 days. Battery-electric vehicles (BEVs) took longer to move at around 89 days.

With weakening demand and improving supply, %RVs of 36-month-old cars decreased slightly by 0.2% compared to May, reaching 54.3% on average. This marked a 2.8% year-on-year gain but shows that pressure on RVs is increasing.

HEVs are currently leading with a %RV trade value of 57.6% followed by petrol cars (55.3%), diesel cars (54.4%) and PHEVs (53%). Meanwhile, 36-month-old BEVs retained the lowest value, at 48.4%. As demand is expected to weaken while supply recovers, further pressure on RVs can be expected. Therefore, RVs of 36-month-old used cars will remain relatively high but on a decreasing trend.

‘The market’s average %RV of a 36-month-old car at 60,000km is forecast to end 2023 approximately 2.4% down compared to December 2022. For 2024, %RVs are expected to decrease by around 3.4% year on year due to weakening demand and increasing supply,’ said Robert Madas, Eurotax (part of Autovista Group) regional head of valuations, Austria, Switzerland, and Poland.

Postponed purchasing in France

The French used-car market was stable in June. A slight increase in absolute RVs was observed, likely due to marginally higher list prices. But the sales volume decreased, with the time needed to sell a used car rising. The fastest-selling models were the smallest and cheapest vehicles, such as the Dacia Sandero with less than 30 days. This was followed by A and B-segment cars.

‘Recent high prices on the used-car market have resulted in postponed purchase decisions, a trend which has become more visible each month. This will likely lead to decreasing residual values in the coming months,’ said Ludovic Percier, Autovista Group residual value and market analyst for France.

Petrol-powered models are following the global trend, with a slight increase in absolute RVs. Yet these vehicles did see %RVs stabilise month on month. The RVs of diesel and hybrid powertrains also remained stable in June, but there was a decrease in sales volumes.

Only diesel kept a consistent number of average days to sell, while hybrids took longer. Even with their tarnished reputation and the implementation of low-emission zones, diesel RVs have not fallen very far. High-mileage drivers are not affected by these zones, and they only take effect in cities with 150,000 inhabitants or more. However, from late 2024 and into 2025, the diesel market will be more heavily impacted.

PHEVs saw absolute RVs begin to fall month on month, with a higher volume of sales and cheaper cars on average sold. Compared with May, BEVs saw stable RVs, while sales volumes and average days to sell increased. Fewer private buyers purchased a used vehicle in June. Those who did were budget conscious and looked to older vehicles or a lower segment. Cars over 12 years of age suffered the least.

Government offering needed in Germany

May saw a large increase in new-car registrations, with fleets performing particularly well. The significant increase compared to 2022 was fed by all drive types apart from PHEVs.

In recent years, these vehicles have benefited from a combination of new-car bonuses, tax advantages for the driver and minimal adjustment in day-to-day use, without the obligation of using the electric drive to cut emissions. But this has now changed, and demand has dropped accordingly.

If Germany’s registration recovery continues, petrol could suffer on the used-car market in 2026. This is because, when measured against pre-crisis levels, there were significantly more new petrol cars taking to the roads in May.

Diesel cars remain unaffected and continue to generate less supply, consequently stabilising prices during remarketing. The increasing number of stock days – regardless of fuel type and age – suggests that willingness to buy is dwindling and customers are becoming more reluctant to opt for younger used cars.

However, the resulting price pressure is only likely to have a temporary effect. In the short term, the continued lower market volume will not offer the opportunity to compensate for falling prices, resulting in margins with higher unit numbers.

‘In the coming year, prices are expected to rise again, especially for the currently weak electric vehicles (EVs). A government offering is urgently needed to stimulate demand for used vehicles with plugs,’ said Andreas Geilenbruegge, head of valuations and insights at Schwacke (part of Autovista Group).

‘Previous measures, which were almost exclusively aimed at new purchases, now need to be replaced by effective support for EV operation and maybe even PHEVs. As long as energy costs, for example, do not become more attractive, it is possible that demand will lag behind rapidly growing supply,’ he added.

Slow turnaround in Italy

In June, the Italian used-car market recovered slightly from the decline observed in May. But with %RVs only increasing by 0.3% month on month, this should be considered as a sign of stability, rather than an indicator of recovery.

‘Year-on-year growth can be expected to slow in the second half of 2023,’ said Marco Pasquetti, head of valuations, Autovista Group Italy. ‘While many crises observed over the past couple of years are fading, such as long new-car delivery times, this turnaround is taking longer than originally hoped. Accordingly, the RV outlook for 2023 has been adjusted marginally to a year-on-year increase of 5.9%.’

Average days to sell sped up in June to 48.3. This is 10.5 days less than a year ago and 14.4 fewer than in May. BEVs, PHEVs and HEVs recorded a particularly good performance, taking less than 40 days on average to sell.

The RVs of BEVs were among the few to fall in June, dropping by 0.8% month on month, with an absolute trade value of just over €16,000. With the same absolute RVs, it might appear buyers are prepared to pay the same amount for a BEV as a petrol model. However, this is where %RVs need to be accounted for.

Petrol cars retained 53.6% of their list price in June, whereas BEVs only managed 37.5%. So, three years ago a new petrol model might have cost €30,000, but a new BEV would have cost roughly €13,000 more. This suggests that many Italians still fail to recognise the benefits of owning an all-electric vehicle.

Price pressure in Spain

For the fifth consecutive month, new-car sales in Spain were up, growing 8% year on year in May. Accumulating 404,337 registrations in the first five months of 2023, the country saw a 27% increase on the same period in 2022. But uncertainty remains as the private channel is still very subdued.

As in previous months, the rental channel has shown significant growth, with one out of four sales in May going to this market. This impacts the dynamics and profile of the used-car market in terms of age, make and model. The used-car market grew by 4% and did so through younger cars.

The situation also influenced the scenario of best-selling brands and models. This means the promotion of vehicles with a rental profile and brand models such as MG, which are widely available and have a strong presence among rental companies.

‘The greater availability of young used cars puts more pressure on prices, visible in the absolute RVs of cars up to 12 months old. Despite high availability, the older the model, the better its residual value held up. Vehicles over 15 years old still accounted for 40% of transactions,’ commented Ana Azofra, Autovista Group head of valuations and insights, Spain.

In terms of powertrains, the negative evolution of BEVs has intensified, with all-electric cars depreciating faster than any other technology, including PHEVs. The market has not reached maturity in terms of infrastructure and the price war initiated by Tesla is likely to have put downward price pressure on other manufacturers, especially those in the mainstream market.

This slowdown in demand for BEVs was also reflected in stock turnover. A used BEV currently takes 81 days on average to sell. This is 20 days longer than a petrol car and almost twice as long as a HEV at 44 days. Hybrids continue to enjoy positive momentum, with three Toyota models at the top of their respective rankings, taking the least time to sell.

Opposed supply and demand in Switzerland

Switzerland has seen increasing levels of supply in recent months, except for young-used cars when compared with pre-COVID-19 years. Additionally, transactions have slowed since the beginning of this year, with little sign of recovery from a weak 2022.

However, the active market volume index did see a 2.4% month-on-month increase, and a 40.1% incline on June 2022 across all two-to-four-year-old passenger cars. The sales-volume index dropped by 1.7% compared to May but is still up 11.2% year on year.

With increased supply and declining demand, the average %RV of a 36-month-old car hit 50.5% in June, falling 0.7% month on month, but still up 1.5% year on year. PHEVs aged 36-months retained 48% of their original list price. Slightly above this were BEVs (48.2%), diesels (49%), and petrol cars (51.4%). HEVs posted a particularly strong year-on-year %RV gain of 11.4%, reaching 54.6%.

Passenger cars aged two-to-four years were in stock for 81 days, up 3.7 days from May. HEVs sold the quickest after an average of 43 days, followed by petrol cars after 79 days, then diesel cars and BEVs after 84 days, and finally, PHEVs after 98 days.

‘As used-car demand is expected to weaken amid overall high and stable supply, a further and slightly accelerated decreasing trend can be expected, although values of three-year-old used cars remain relatively high,’ said Hans-Peter Annen, head of valuations and insights, Eurotax Switzerland (part of Autovista Group). ‘The %RV is forecast to finish 2023 down roughly 4% on December 2022. In 2024, RVs are expected to fall by around 3.9% year on year due to constant supply and lower demand.’

Seasonal change for UK

The average volume-weighted RV of a three-year-old car in the UK sat at £17,792 in June. This represents 64% of the original cost-new price, which is down from 65.9% in May.

The intensity of used-car activity has slowed in recent weeks too. However, this is a fairly typical market trend in the summer months, with consumer focus seeming to switch to other priorities over the holiday period.

‘The sales-volume index certainly points towards slowing activity,’ said Jayson Whittington, Glass’s (part of Autovista Group) chief editor, cars and leisure vehicles. With May’s transactions represented as 100%, the index indicated 91.2% observed retail sales in June.

‘It is therefore unsurprising to see the volume of cars being offered by dealers increasing, with 4.5% more units advertised compared to the previous month. It is encouraging to see, however, that 4.3% more retail sales were generated compared to the same period last year,’ Whittington added.

The average movement of a three-year-old BEV followed the general market trend last month, settling at a new price point and falling from 47% of the cost-new price in May to 45% in June.

The average absolute RV now sits at £19,962, which is still £2,170 greater than the average value of combined fuel types. This is despite BEV %RV sitting at 45% in June, compared with all combined fuel types which retained 64% of the original list price.

This content is brought to you by Autovista24.

Close

Close