As carmakers adjust to a more electrified, connected, and digitally-enabled automotive reality vehicle-equipment strategies are changing.

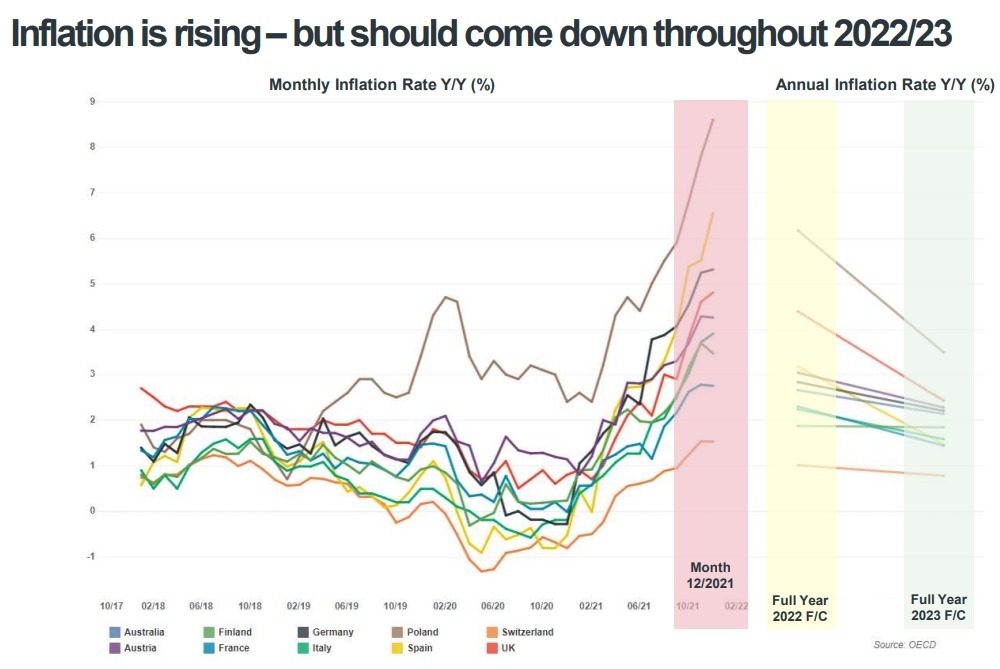

Living costs are rapidly increasing in all European countries, affecting new-car prices. Higher prices for raw materials and labour costs are driving list prices up, but factory-fitted standard equipment is also increasing. With less money in their pockets, consumers are postponing purchases. So, manufacturers need to find the right balance between affordability and attractive standard equipment.

Companies are also looking to lower costs and reduce production complexity. Simplifying equipment strategies leverages economies of scale, which should help ease pressure on the supply chain, increasing the availability of new cars. Furthermore, pan-European equipment strategies facilitate profitable cross-border sales of new or used cars. More unified approaches also enable features on demand (FOD), which require pre-installed hardware.

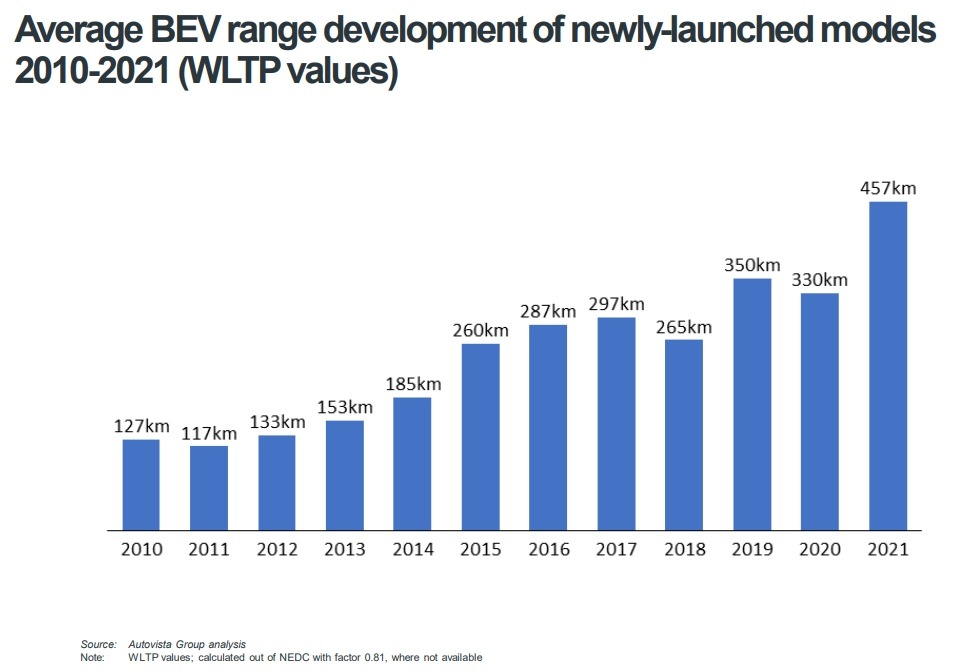

At the same time, the challenges surrounding vehicle equipment are higher than ever before. EU regulations are forcing manufacturers to build in more safety and driver-assistance features, such as intelligent speed assistance systems. Infotainment performance will become a major differentiator and requires huge investments in technologies and software development.

These topics set the scene for the latest Autovista24 webinar, ‘How vehicle-equipment strategies are changing in the automotive market’. Autovista Group experts discuss current challenges, present data on how standard equipment and trim lines changed between 2019 and 2022, and share insights on equipment strategies applied by carmakers.

Complexity reduction

Christian Schneider, head of analytics at Autovista Group, analysed how rising list prices are connected to an increase in standard equipment. He took a closer look at the factory-fitted equipment on the German market.

For example, while LED headlights were standard equipment in just over 40% of cars in January 2019, the fitment rate doubled to over 80% in June 2022. ‘This means that 80% of cars now have this rather expensive feature worth between €1,000 and €1,500 built-in, and that compensates for the list-price increases to a certain extent,’ Schneider explained.

Other examples include DAB radios or navigation systems, many of these feature developments driven by either regulation or a change in consumer preference. The rate of factory-fitted 360° camera systems in D-SUVs doubled since 2019, probably related to cars becoming bigger. ‘We do expect this trend to continue, especially when it comes to EU-regulated safety features. This will also drive list-price increases further,’ added Schneider.

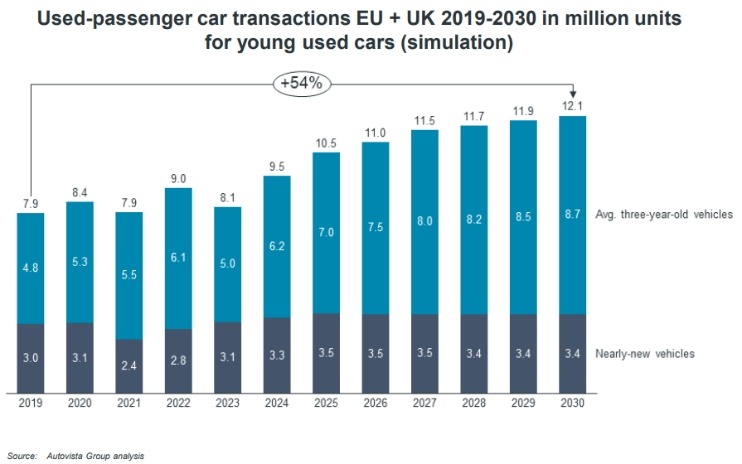

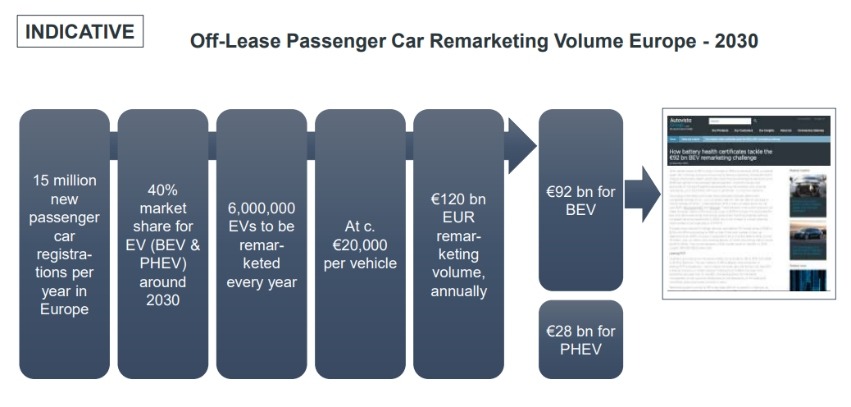

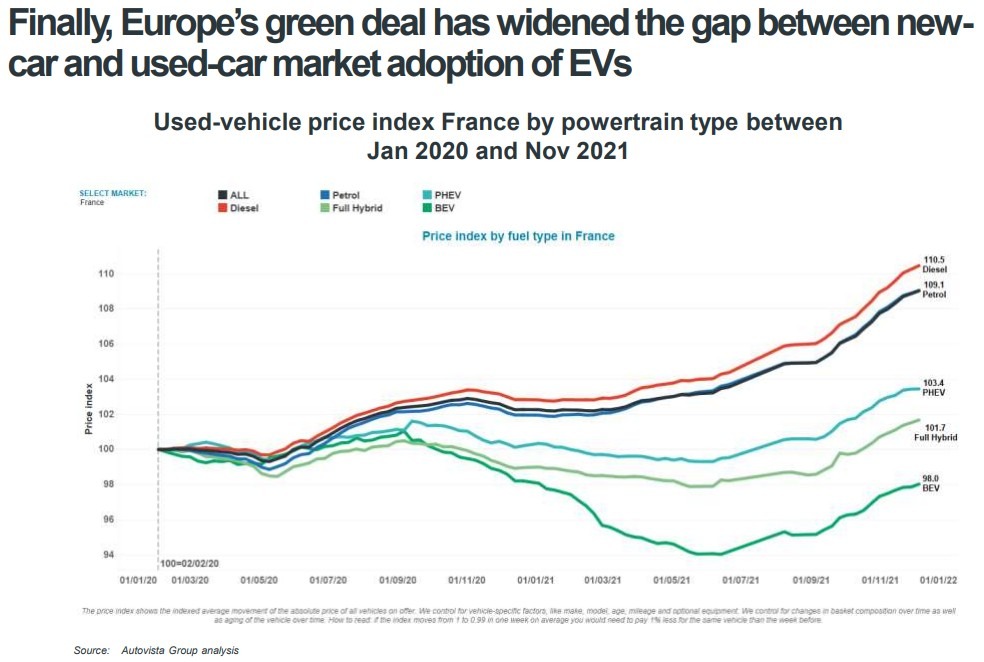

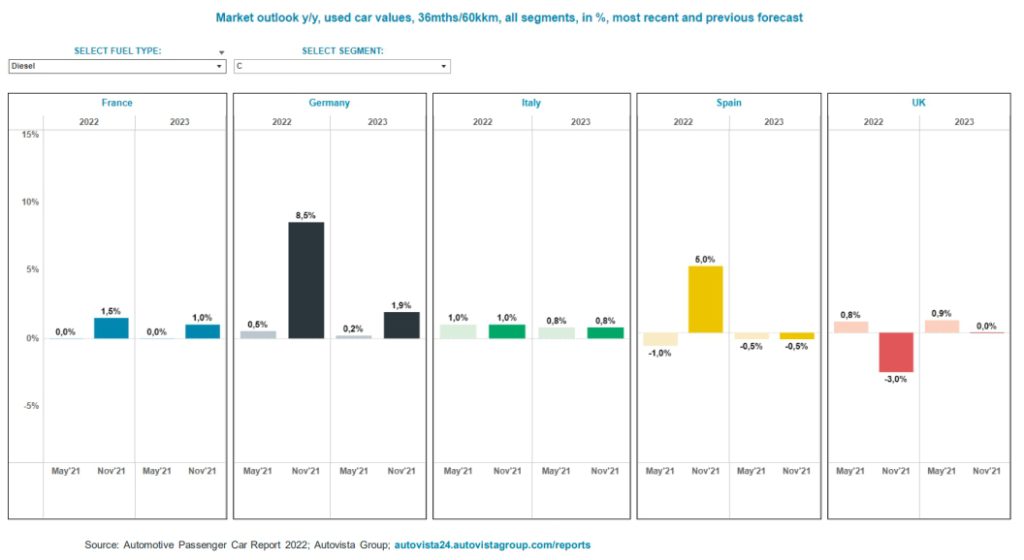

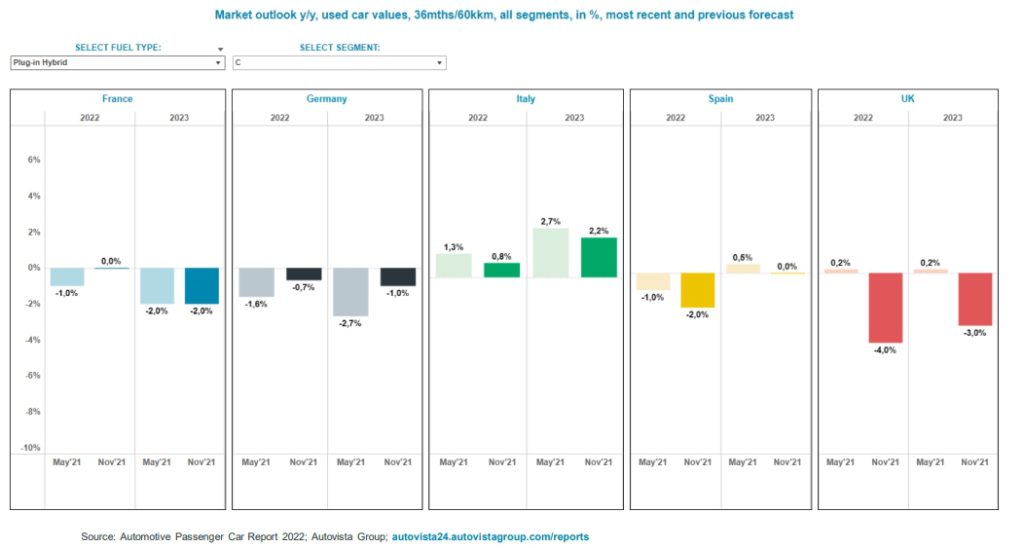

‘An increase in standard equipment also helps to simplify a carmaker’s equipment strategy and reduces complexity,’ he said. There is a clear trend of OEMs offering fewer trim lines. More complete standard equipment, together with rising list prices, also bolsters residual values (RVs), along with inflation and the limited availability of used cars.

Carmakers take different approaches

The most common equipment strategies applied by car manufacturers are the hierarchical trim walk, the Y-type strategy, and the base-plus-options approach. While the hierarchical trim walk has lines building on top of each other, the Y-type strategy advances into a sporty and luxurious branch, for example. The base-plus-options approach is traditionally used by premium manufacturers. It comes with the risk of introducing underequipped models to the used-car market, as well as increasing the difficulty in identifying built-in features.

‘In Car To Market studies, we therefore always analyse the standard and optional equipment of a model. By doing so, we can give our customers recommendations not only in comparison to their direct rivals but also in light of used-car market trends and requirements,’ said Guillermo Iniguez, senior market analyst at Autovista Group.

With the entrance of several new players into European markets, established carmakers also need to closely observe and potentially adjust their approaches. ‘New players typically avoid entry-trim versions and come with a high level of standard equipment,’ Iniguez explained. This approach gives many new players a head start on RVs.

To avoid residual value risks, some general rules include making high-demand features standard and integrating other popular or trending items into a clear and logical trim walk. The naming of trims and packages should give clear guidance for a used-car customer, such as ‘winter pack’ or ‘executive pack’.

FOD – the new kid in town

While the industry used to differentiate between standard and optional equipment in the past, there is a new kid in town now – features on demand.

Generally, FOD is a great opportunity to keep a car updated, allowing for flexibility on the used-car market and helping establish a direct customer relationship throughout a model’s lifecycle. However, it does not come without risks. Carmakers must select the right features and set the right price, especially as cars get older. Commercially viable FODs need to be selected based on the expected demand and the hardware pre-instalment costs.

Vehicle-equipment strategies find themselves at the core of automotive decision-making and are bound to change, adapting to the megatrends disrupting the industry. Robust RVs are always subject to the reconciliation of requirements between the new-car market and the used-car market. In the future, a robust hierarchical trim strategy that avoids costly mistakes in the form of underequipped cars and unidentifiable features will also be crucial.

Close

Close