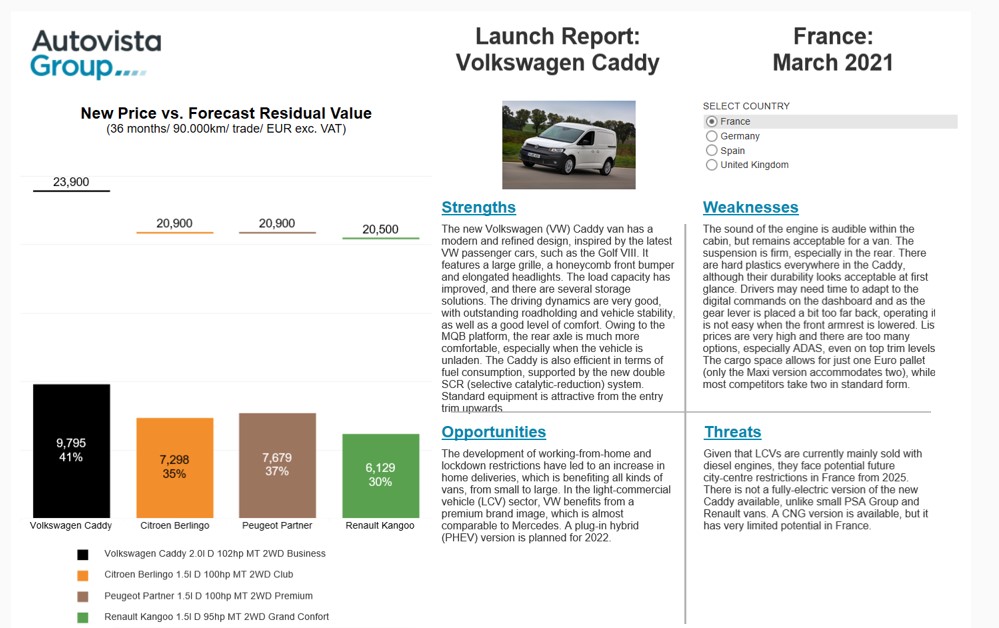

The Volkswagen (VW) Caddy has been redesigned from the ground up, with improved safety, space, engines, and advanced driver-assistance systems (ADAS). The fit and finish, digital cockpit, and general specification improvements make the model feel more like a VW passenger car. The driving dynamics are very good too, with outstanding roadholding and vehicle stability, as well as a good level of comfort.

Both the Caddy and the Caddy Maxi have grown in length and wheelbase, providing more cargo space. As the model is bigger, the maximum payload is slightly lower, but is the highest among key competitors. However, the loading volume of the Caddy is slightly below average, with the cargo space allowing for just one Euro pallet (only the long-wheelbase Maxi version accommodates two), while most competitors take two in standard form.

The new model hosts a comprehensive offer of assistance systems, including trailer-assist, which is a unique selling point in the segment. The modern interior and digital cockpit are advantageous for dual-use customers, i.e. drivers that use the vehicle for both commercial and private purposes.

The latest Euro 6 diesel engines benefit from huge emissions reductions and better fuel economy, supported by the new double SCR (selective catalytic-reduction) system. The 102-horsepower 2.0TDI has the lowest fuel consumption and CO2 emissions among its key rivals. There is not a fully-electric version of the new Caddy available, unlike small PSA Group and Renault vans. However, a plug-in hybrid (PHEV) version is planned for 2022. A compressed natural gas (CNG) version is already available in France, and will be available to order in Spain from December 2021.

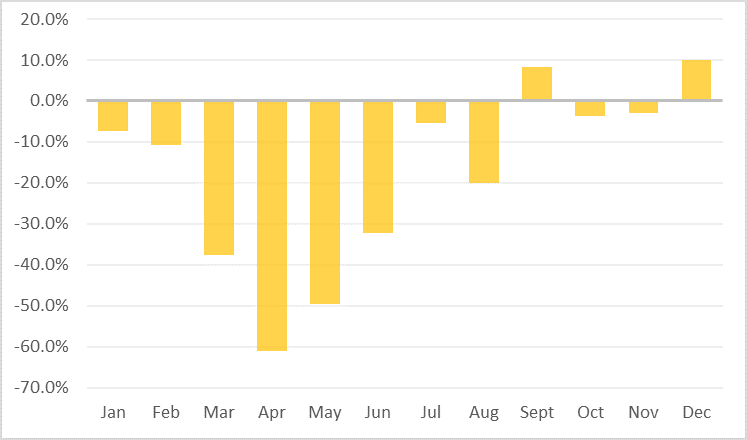

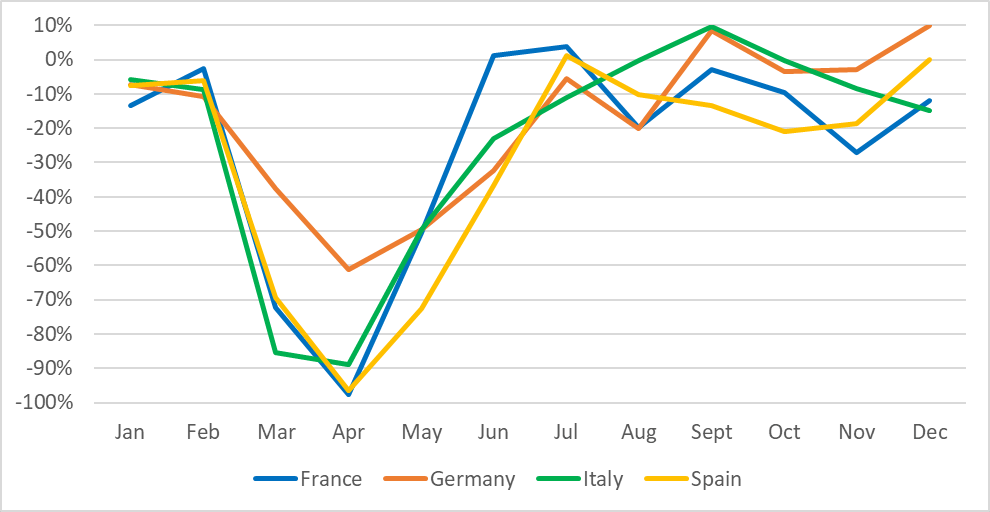

The Caddy has a lower entry list price than its predecessor, but pricing is generally higher than those of other mainstream competitors. However, the fuel savings and reduced CO2 emissions will improve running costs and should entice new buyers. Furthermore, the development of working-from-home, and closures of non-essential retail, have led to an increase in home deliveries, benefiting demand for vans, and their residual values (RVs).

Click here or on the image below to read Autovista Group’s benchmarking of the VW Caddy in France, Germany, Spain and the UK. The interactive launch report presents new prices, forecast RVs and SWOT (strengths, weaknesses, opportunities and threats) analysis.

Close

Close