Battery-electric vehicles (BEVs) will achieve price parity with their fossil-fuel counterparts across Europe from 2027 at the latest. This is according to the results of a new BloombergNEF study commissioned by the clean-transport campaign group Transport and Environment (T&E).

Electrically-chargeable vehicle (EV) adoption is increasing with help from incentive programmes and expanding model offerings. In the first quarter of this year, BEVs accounted for 5.7% of EU new-car registrations, an increase of 59.1% compared to the first three months of 2020. Plug-in hybrids (PHEVs) took 8.2% of the market, equating to an increase of 175%. Meanwhile, diesel and petrol-powered cars continued to see falling volumes.

However, the automotive industry is still in the early stages of electrification. Presently, those investing in EVs have both the confidence and capital to invest in electric drivetrains. As components, particularly batteries, become cheaper and more technologically advanced, EV price tags should shrink.

Price parity

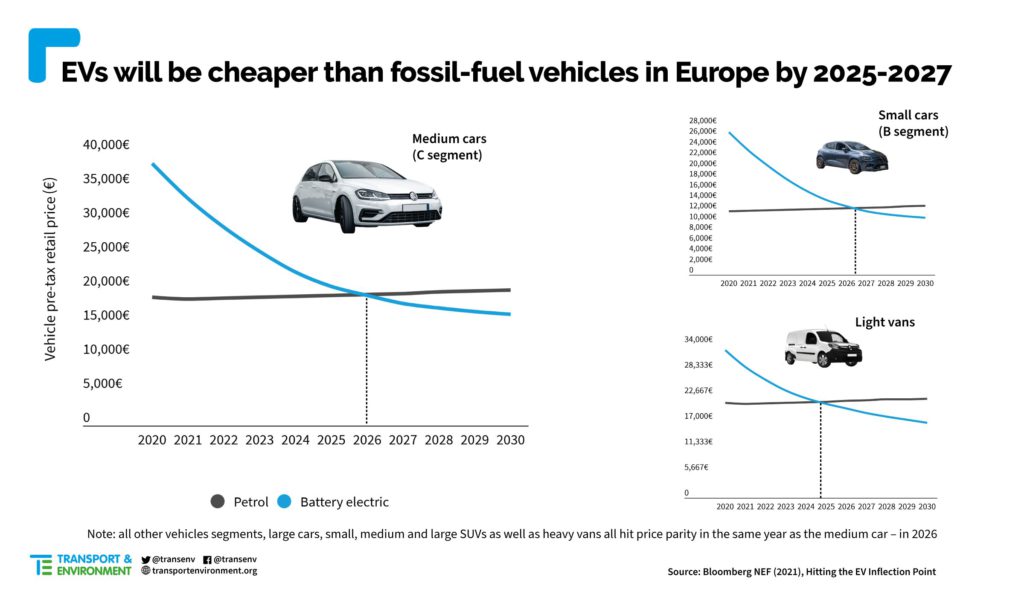

The segment will dictate a BEV’s point of price parity with petrol in the coming years, with larger vehicles becoming more affordable more quickly. According to the BloombergNEF study, light vans will lead the charge, becoming cheaper than their ICE counterparts in 2025. BEVs in the C and D segments will follow in 2026, while small cars (B segment) bring up the rear in 2027.

Source: T&E

‘EVs will be a reality for all new buyers within six years,’ said Julia Poliscanova, senior director for vehicles and e-mobility at T&E. ‘They will be cheaper than combustion engines for everyone, from the man with a van in Berlin to the family living in the Romanian countryside. Electric vehicles are not only better for the climate and Europe’s industrial leadership, but for the economy too.’

Building better batteries

So, what will be the driving force behind shrinking costs? The BloombergNEF study points to falling battery costs, new vehicle architectures and dedicated production lines as leading factors in reducing price, even before subsidies come into the equation. ‘An optimal vehicle design, produced in high volumes, can be more than a third cheaper by 2025 compared to now,’ the study states.

Source: T&E

Batteries in particular have had an important role to play as they have consistently been the most expensive EV component over the past decade. In the US, they currently account for roughly 30% of an EV’s cost. In Europe, prices are more widely spread, raising the continent’s average battery price above the global average – resulting partly from some lower-volume orders. But as battery prices fall and more optimised platforms are developed, EV prices should follow.

‘New chemistries, better manufacturing methods, innovative cell and pack-design concepts and other factors contribute to average prices per kilowatt-hour declining by 58% from 2020 to 2030,’ BloombergNEF points out. Past this point, new technologies like the solid-state battery will continue to drive down price. These smaller, more powerful units are seeing an uptick in interest from OEMs. Most recently, BMW and Ford led an investment round in Solid Power, a producer of solid-state batteries.

Plugged-in projections

Europe could see 4.3 million plug-in vehicles sold in 2025, representing roughly 28% of the market. BEVs would capture over half of those sales, with the rest made up by PHEVs as carmakers use them to meet emissions targets. In an economics-driven scenario, BloombergNEF believes BEVs could claim up to half of Europe’s market share of sales by 2030 and 85% by 2035.

T&E points out that battery-electric cars and e-vans could reach 100% of new sales by 2035 – including southern and eastern Europe, where initial take-up rates have been comparatively slow. However, this would be dependent upon lawmakers ramping up CO2 targets and producing policies to stimulate market developments including the introduction of more infrastructure. The environmental group states that without these additional policies, battery-electric cars will claim 85% of the EU market and e-vans 83%. This would mean missing Europe’s goal to decarbonise by 2050.

‘With the right policies, battery-electric cars and vans can reach 100% of sales by 2035 in western, southern and even eastern Europe,’ said Poliscanova. ‘The EU can set an end date in 2035 in the certainty that the market is ready. New polluting vehicles should not be sold for any longer than necessary.’

In April, T&E published the results of a poll of 15 European cities showing that nearly two thirds of urban residents support a ban on the sale of new petrol and diesel cars by 2030. Additionally, Volvo Cars, Uber and LeasePlan were recently among a group of companies calling for an end date to new ICE car purchases in Europe no later than 2035. While requests for electrification mount alongside evidence of EV credentials, shrinking price tags will undoubtedly increase adoption rates.

Close

Close