Senior data journalist Neil King considers how the big five European used-car markets developed in the first quarter of 2021.

Europe’s big five used-car markets exhibited further resilience in the first quarter of 2021. The total volume of transactions grew year on year in France, Italy, and Spain. Germany and the UK endured single-digit declines, but dealer activity was hampered by COVID-19 restrictions. Nevertheless, the year-on-year performance of both used-car markets outperformed the respective new-car markets.

Used-car transactions in the first quarter increased by 17.9% year on year in France, according to the French industry association CCFA. This was slightly lower than the 21.1% year-on-year growth in new-car registrations. However, these figures were adversely affected by comparing to a period that included the start of the country’s lockdown, from mid-March 2020.

This situation was replicated in Italy, with 11.5% growth in used-car transactions in the first quarter of this year, according to trade body ANFIA. This compared to 28.7% growth in new-car registrations as the country entered lockdown earlier last year, on 12 March.

In contrast to the dramatic 14.9% year-on-year decline in new-car registrations in Spain in the first three months, used-car transactions increased, albeit by just 1.1%, according to GANVAM, the Spanish dealers’ association. However, GANVAM cautions that ‘the average age of used passenger cars sold until March reached 10.6 years, compared to 10.4 last year, and exceeded 14 years – compared to 13.6 in the first quarter of 2020 – in the transactions between individuals.’ This exemplifies the demand for cheap used cars across Europe as a substitute for public transport in the wake of the COVID-19 pandemic.

‘The used-car market in Spain is always more favoured than the new-car market in times of crisis. The age structure of these sales has changed substantially in recent months and will continue to do so throughout 2021. The most notable change is undoubtedly the lower prevalence of young used cars in the market, caused by the standstill in tourism and the lack of renewal of rental fleets,’ explained Ana Azofra, Autovista Group head of valuations and insights, Spain.

Downturns in Germany and the UK

Whereas used-car demand increased in France, Italy and Spain in the first quarter of 2021, it contracted in Germany and the UK due to COVID-19 restrictions. However, the downturns were less pronounced than in the new-car markets, which rely far more heavily on the dealer network.

In Germany, the used-car market contracted by 4.6% in the first three months of 2021, according to the motor-vehicle authority KBA. However, dealerships in the country could only reopen, conditionally, from 8 March. This naturally impacted the new-car sector more, with registrations down 6.4% year on year in the first quarter. Schwacke expects a slight improvement in used-car sales compared to 2020. ‘The used-car business was quite successful under the circumstances and sold slightly more than seven million cars by the end of 2020. The forecast for 2021 is the same – around seven million cars,’ commented Andreas Geilenbrügge, head of valuations and insights at Schwacke.

The UK’s used-car market suffered the greatest downturn of the big five European markets in the first quarter of 2021, with 8.9% fewer transactions than in Q1 2020, according to the UK Society of Motor Manufacturers and Traders (SMMT). However, this compares favourably to the new-car market, which contracted by 12%, as it was more adversely affected by the closure of dealers until 12 April. Used-car transactions are expected to improve in 2021, but with a lower growth rate than new-car registrations.

‘Among the turbulence, demand for used battery-electric (BEV), plug-in hybrid (PHEV) and hybrid vehicles (HEV) remained strong in Q1. Buyers were keen to purchase pre-owned ultra-low and zero-emissions cars, helped by increased availability and more models available,’ the organisation stated.

SMMT chief executive Mike Hawes has also highlighted the positivity, commenting that ‘the second quarter will see significant growth as last year’s April and May markets were severely limited by lockdown measures. It is vital that the used market is rejuvenated to help sustain jobs and livelihoods, drive fleet renewal and support environmental progress. With car showrooms open again and the UK coming out of COVID restrictions, the sector can look forward with renewed optimism.’

Supporting residual values

The ongoing comparative strength of Europe’s big five used-car markets supports Autovista Group’s core prediction, outlined at the start of the year, that residual values (RVs) face limited pressure in 2021.

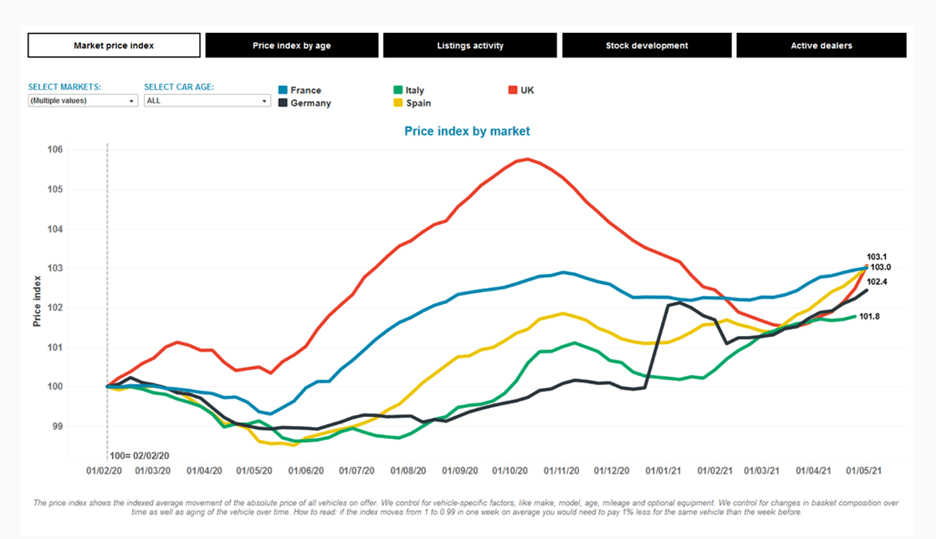

Autovista Group’s COVID-19 tracker shows that the RV index finished 2020 at or above pre-crisis levels in all of Europe’s major markets. The measurements began in February 2020, with an index value of 100. RVs retreated in most markets at the start of 2021, but have recovered again in recent weeks and remain firmly above pre-crisis levels.

Source: Autovista Group, Residual Value Intelligence, COVID-19 tracker

Looking ahead, the economic fallout from the COVID-19 pandemic, as well as the ongoing aversion to public transport, will support used-car demand. Furthermore, the semiconductor shortages are curtailing supply of new cars, favouring demand for young used cars.

Autovista Group’s latest monthly market dashboard reveals that the average value retention of cars, represented in RV-percentage (RV%) terms, improved month on month in four of the big five European markets in April. Italy was the exception, where the average RV% fell, albeit by only 0.8%. However, in value terms, average RVs declined by 2% and 0.5% in Italy and Spain, respectively. This ties in with demand for cheaper used cars, in the same way that older used cars increased the average age of used cars transacted in Spain in the first quarter of 2021.

For now, RVs in the 36-month/60,000km scenario remain above levels of a year ago in all markets. But they are forecast to end 2021 slightly down compared to December 2020, except in the UK. The poorest RV outlook is in Italy, where values are currently forecast to fall by 2.3% in trade percentage terms. Used cars have not weathered the COVID-19 storm better than new cars, and the introduction of additional incentives for low-emission new cars has applied more pressure on used-car demand and RVs.

Close

Close